Business Insurance in and around Sidney

Calling all small business owners of Sidney!

Almost 100 years of helping small businesses

Business Insurance At A Great Price!

Whether you own a a hair salon, a pet groomer, or a hearing aid store, State Farm has small business insurance that can help. That way, amid all the different decisions and moving pieces, you can focus on making this adventure a success.

Calling all small business owners of Sidney!

Almost 100 years of helping small businesses

Protect Your Future With State Farm

The passion you have to serve your customers is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Michele Herres. With an agent like Michele Herres, your coverage can include great options, such as artisan and service contractors, worker’s compensation and commercial auto.

Let's discuss business! Call Michele Herres today to see why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

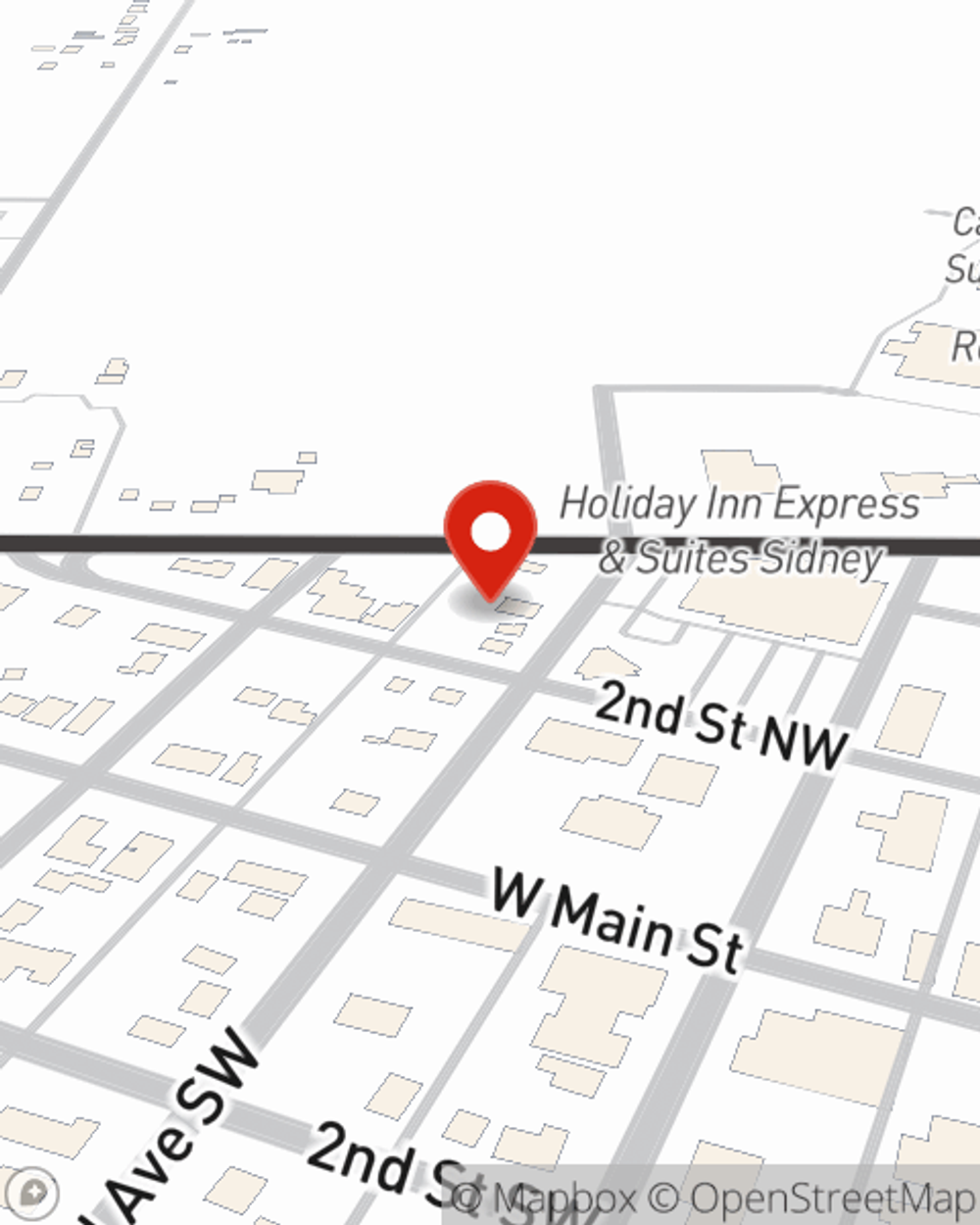

Michele Herres

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.